Chargeback is the process of cancellation by the bank a card transaction made by a holder of Visa or MasterCard electronic cards at a sales outlet or online store. Chargeback is a procedure for appealing a bank transaction by a card holder. In simple words, chargeback is the ability to return money back to the card in case of illegal actions of the seller.

The Cosmovisa chargeback service is a free online service that allows you to refund your money using the chargeback procedure. The service does not require any special knowledge. Any user can make a refund. You just need to register, fill out a step-by-step application and expect a refund on your card. Everything is simple!

In what cases can you get a refund?

You can have your money refunded in the following cases:

- The product received does not match the description on the website.

- The services have not been provided in full or not provided in all.

- The buyer did not receive the product or service after payment.

- The seller refuses to exchange/replace the goods.

- The seller did not make the promised refund.

- The amount was debited twice.

- The amount debited is more than the declared value of the goods.

- The amount was debited from the card for the goods that the holder did not buy.

- An ATM did not give out money, but debited the card account.

So, for example, if you paid for the goods on a website, you can get your money back to the card if the goods have not been delivered to you, turned out to the desciption on the website. At the same time, it is important that the payment is made through a Visa or MasterCard card, because the chargeback tool is provided by these payment systems. Chargeback is not a bank service. If you go into details, banks are obliged to accept chargeback applications under an agreement with Visa and MasterCard payment systems, but not all banks comply with it, especially regional ones.

Chargeback procedure

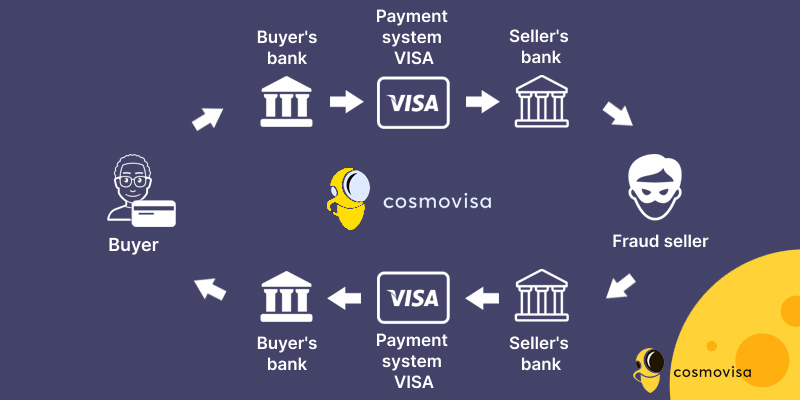

So, there are 5 roles in the chargeback procedure: the card holder, the bank that issued the card, the payment system, the bank of the outlet, and the seller itself. The card holder initiates a chargeback by submitting an appropriate application to the bank; the bank, having considered the application, applies to the payment system; the payment system, having studied the documents, makes a request to the bank of the outlet to explain or refund the money; if the bank of the outlet agrees with the claims, it refunds the money, if it does not agree, it engages the seller in the dispute and the debate process starts. Briefly, the process looks something like this, but there are other scenarios. Below is a diagram showing the refund process.

The procedure for appealing a payment is carried out by the issuing bank (the bank that issued the card). In order for the bank to accept an application for the chargeback procedure (application for appealing a transaction), you need to write an application in which you indicate the reason for which you are applying. You should submit a completely correct application so that the bank registers your application in accordance with the rules of payment systems. In this whole scheme, payment systems will be the most important intermediary, as a judge, in making a decision. That is why the right application is the main and first thing.

Chargeback deadlines

The payment systems set the following deadlines for the chargeback:

• 540 days - the official period during which the client can initiate an appeal of a transaction. However, sometimes banks can set their own shorter deadlines of 45 to 180 days, violating the rules of payment systems.

Each bank works and initiates the chargeback procedure in its own way. Accordingly, they consider your application within different deadlines. Some will consider the application in 1-2 days, some will consider it as long as 120 days. Also, the consideration period can be extended if such an instruction is given by payment systems.

• There are banks that do not want to accept an application for a chargeback procedure. In this case, an official response should be requested from the bank with the reason why the bank does not accept an application to appeal a payment.

In case of refusal of the refund, according to the application, do not forget that you have the right to re-apply with new facts for payment systems, meeting the deadline that is usually 3 to 14 days. You should find out the deadlines in the bank on the day the response is provided with the refusal of the refund.

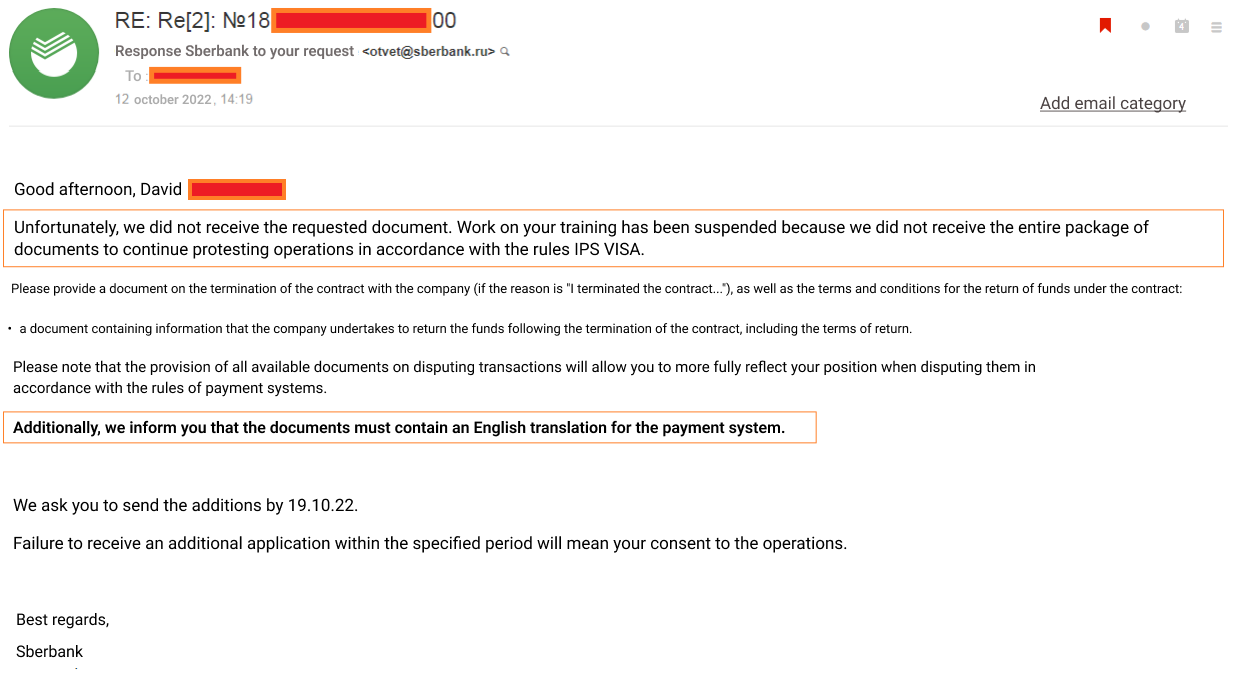

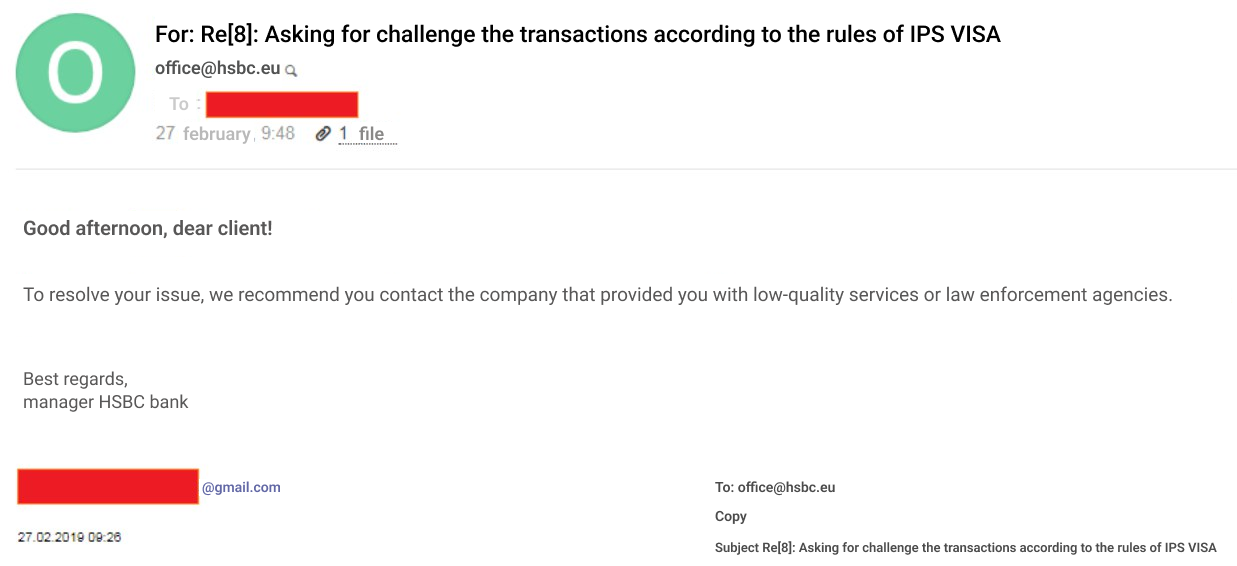

It is very easy to violate the deadlines of the chargeback procedure. It is especially easy if the bank does not try to help you and does not notify you of the expiration of the deadlines. Below is an example, the client provided us with a response from Sberbank on his application. The client submitted an application on his own and he was informed of the deadlines and what documents he had to provide in his case for payment systems. The client absent-mindedly missed the deadlines and, as a result, he was refused a refund.

Requirements for a chargeback

Below is a list of what you need for a chargeback:

- Application. All applications for the chargeback procedure must be submitted in Russian and English, with high-quality translation for payment systems. Some banks translate documents on their own, but they are not many.

- Evidence. In other words, it is the grounds for the refunds of the deposit/payment. You should provide a correspondence/agreement/ offer from which it is clear that your rights have been infringedor you were promised something, but you did not receive it. Screenshots, links, etc. will also be good.

- Correspondence with the seller. It is very important for the payment system and the bank to see that you have tried to solve the problem with the seller on your own, requested a refund or withdrawal of the deposit. That is, you have tried to resolve the situation on your own.

- Bank statement. You need a bank statement in order to correctly indicate those transactions that you intend to appeal.

So, you have prepared all 4 points above. Now let’s look at how everything will happen in practice. In practice, everything consists of the following actions: you must write an official application for a chargeback with the details to and from whom. Next, you describe the situation that you paid a certain amount with a card of a certain bank on a certain website. The company promised this, but provided something else or nothing. Further, you give a detailed description of the problem with the seller, with the application of your agreement/offer, screenshots of correspondence with the seller and everything that displays the problem and your participation in its solution. After that, you should write the conclusion of the application, which code you are referring to with all the notes to the application. You should do everything the same, but in English. This is how an application for a chargeback looks like, which will help to positively influence the refund of your money to your account.

The bank is authorized to request additional documents for the chargeback from you with payment information, and will indicate the deadlines within which you have to provide the documents. It is very important to meet the chargeback deadlines and provide everything they request. Each document requested by them will play a big role in the refund of your money to your account. It is very important to provide all documents describing the problem on time, otherwise, according to the rules of payment systems, they will close the chargeback case, and the bank is not authorize to initiate it again. The client must follow the correct course of action if he wants to have funds refunded to his account.

Cosmovisa has consolidated the experience and knowledge of the best chargeback lawyers to reduce all errors to zero. Do not experiment, but entrust the refund to the service created by professionals.

How does the chargeback work?

After the client submits documents to the bank, the issuing bank (the bank that issued the card) must send all the data to the acquiring bank (the bank to which the money was paid). The acquiring bank must block this amount on the company’s account until the situation is resolved. If the company provides data that the client has accepted all the terms and conditions of the agreement/offer and can provide a sound response to the client’s claims, the transaction amount will be unblocked and remain on the company’s account, and the chargeback procedure will be refused to the issuing bank. Next, the issuing bank will notify the client. Accordingly, if the company does not provide a response at all, the blocked amount will be refunded from the company’s account to the applicant’s account.

Reading the information above, you have correctly noted that after the refusal of the refund, you can initiate the chargeback procedure again. After reviewing the company’s response, you can provide new evidence and refute their response. For example, the company presented the data in a different light, that is, they provided information that you had received a call and you had said that you had been satisfied with the service of the company. However, you can provide, for example, data in a note to the application that you received a call on HH.MM.YY. and that was before you started having problems with the company, and possibly before you bought the product. Accordingly, screenshots and records of calls and screenshots of problems with the company will be evidence. A repeated application for a refund will be considered with the participation of payment systems. Their response will be the final decision for both the buyer and the seller.

Situations of each client are individual and so are the notes to the application. You should clearly understand it. One client signed one document with the same company, the other signed another. Each corresponds and solves problems with the company in their own way. Please note that Cosmovisa cannot give you any guarantees. For the reasons listed above, each situation is individual. The company responded to one buyer and provided a response, but the company did not provide a response to the requests of another buyer and the money was immediately debited, and there was a quick refund to the client’s bank account. We would recommend that you beware of other law firms and their money refund guarantee. You need to be especially attentive to chargeback companies that request an advance payment.

We recommend that you carefully study the companies before making a payment with bank cards on their website or making a deposit. After all, fighting for your money in case of fraud is more difficult than making a transfer.

How difficult is the chargeback procedure for an average user?

If you intend to initiate a chargeback yourself, then be prepared for a lot of difficulties. The following is a real case. For example, you have been defrauded by a Forex Broker. You have given your money into trust management, but you cannot withdraw the money back because the website stopped working, and support responds very slowly. The reason for your appeal is that the service was not provided to you, or it was provided but it differs from the agreements, and you decided to apply for a refund yourself to the bank. However, the problem is that not every bank employee is qualified enough and knows all the features of the chargeback procedure and how it works in practice. Also, employees usually put down special codes, as a rule, they put the first one proposed by the program (for example, 81), the service does not play any role here, the code means that the payment was fraudulent, which is not true. Usually, employees indicate this code if you refer to company fraud in the application, but fraud is difficult to prove, so other reasons must be used. Therefore, you need to refer not to the company fraud, but to the fact that the service was not provided in full, according to the agreement, and you incur losses because of the actions of the company. Accordingly, this is a different code. But because of this error, be sure that you will never get a refund.

It is important that the payment was made with your bank cards: the service was paid for on the company’s website, you received an SMS confirmation on your phone, and you entered it. There is no payment fraud, you personally deposited funds. According to the offer, you are in the role of an investor and do everything voluntarily. But there is a non-compliance with the offer on the part of the company, namely the impossibility of withdrawal of funds. What does it mean? This means that if your evidence does not match the stated reason, you will just get a refusal. There is one more nuance, you can submit a repeated application within 14 days with new circumstances, evidence, but... But the payment code cannot be changed in the program. Accordingly, you will get a refusal again. And you will be refused not because the Broker skillfully defends itself. The application will not even reach it. You will be refused at the stage of verifying the compliance of the payment. That is why law firms with a cash back and deposit return profile do not accept clients who applied on their own and were refused after initiating a chargeback.

Does the seller defend itself from chargeback?

It is important that the payment was made with your bank cards: the service was paid for on the company’s website, you received an SMS confirmation on your phone, and you entered it. There is no payment fraud, you personally deposited funds. According to the offer, you are in the role of an investor and do everything voluntarily. But there is a non-compliance with the offer on the part of the company, namely the impossibility of withdrawal of funds. What does it mean? This means that if your evidence does not match the stated reason, you will just get a refusal. There is one more nuance, you can submit a repeated application within 14 days with new circumstances, evidence, but... But the payment code cannot be changed in the program. Accordingly, you will get a refusal again. And you will be refused not because the Broker skillfully defends itself. The application will not even reach it. You will be refused at the stage of verifying the compliance of the payment. That is why law firms with a cash back and deposit return profile do not accept clients who applied on their own and were refused after initiating a chargeback.

If your case meets the points listed below, the chances of a chargeback tend to zero:

- The payment was made more than 540 days ago.

- The payment was made in cash.

- You applied to the bank on your own and got a refusal.

- The payment was made by a direct transfer or from card to card.

We can not

Help you get your money back via the Chargeback procedure

If:

1. Damage amounts to less than $1000

2. More than 5 years have passed

Beware of legal companies that guarantee a 100% success rate in returning your funds and within 1-2 weeks. Never transfer funds to private credit cards of these lawyers - they are scammers!